UPM+ Claims Management

CONSISTENT OUTCOMES. FASTER TURNAROUND.

The most flexible Claims Management System for Underwriting Agencies Designed to automate manual tasks and assure governance Empowering your people to improve customer service

REAP THE BENEFITS

Claims Management is the market’s most critical business process, influencing competitiveness and financial performance in the complex insurance market. It is paramount to control operational cost and staff efficiency, as well as claims leakage, while assuring accurate reliable claim assessment outcomes.

From claim lodgement to payment, the UPM+ Claims Management System allows you to manage the fine balance between service delivery, cost control and governance

From claim lodgement to payment, the UPM+ Claims Management System allows you to manage the fine balance between service delivery, cost control and governance

CONSISTENCY AND PREDICTABILITY OF OUTCOMES.

As every claim is handled the same way, variations as a result of manual claims handling are eliminated. Consistent processes and controls give certainty for the management of operational expense budgets and claims costs.FASTER SERVICE

through improved claims turnaround times. Adding efficient online self-service across your internal and external stakeholders enables productive collaboration and problem solving. Service cost can be reduced while all required information is easily and securely accessible.MEANINGFUL REPORTING

at the push of a button is a result of transparent processing of all data in one single system, across all your processes and people. You have access to accurate, timely and powerful executive insight reports, operational reports and many more.BUSINESS RULES ASSURE GOVERNANCE AND PROVIDE TRANSPARENCY

through workflow systems, detailed task management and inbuilt document management. You achieve more consistent and predictable outcomes and reduce the risk of human error.

WHAT IS UPM+ CLAIMS MANAGEMENT?

The UPM+ Claims Management system is the most flexible on-demand or on premise business solution that delivers reduced claim handling time, improved staff efficiency, improves service levels and controls claims leakage. The solution can be integrated with your existing systems or as part of the UPM+ Agency Suite, and is supported by a local team of industry experts. All business rules are configurable, which means the system will work exactly the way you want to work and doesn’t enforce changes.

Whether you manage a high volume of claims of lower value, or high value complex claims, the UPM+ Claims Management solution can be tailored to your business model. The system also serves the increasing demand for digital online service delivery to your customers and partners. It is suitable for third party administrators, underwriting agencies and insurers.

Whether you manage a high volume of claims of lower value, or high value complex claims, the UPM+ Claims Management solution can be tailored to your business model. The system also serves the increasing demand for digital online service delivery to your customers and partners. It is suitable for third party administrators, underwriting agencies and insurers.

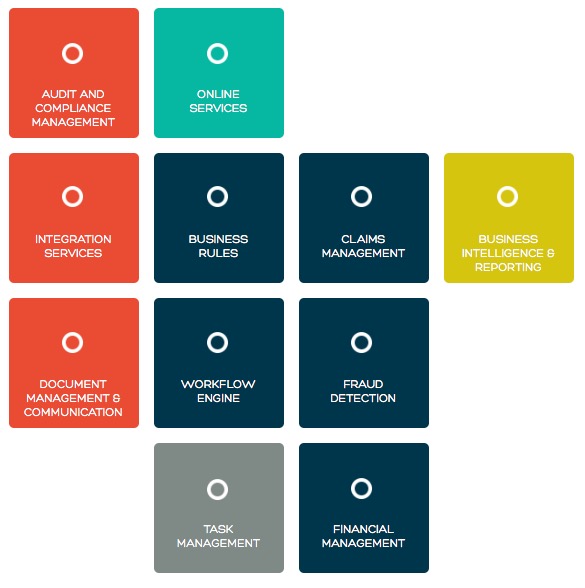

CLAIMS MANAGEMENT MODULES

AUDIT AND COMPLIANCE MANAGEMENT

Accurate and flexible audit trail assures that all the relevant information is logged. Compliance management is achieved through detailed data capture along the entire process including documentation. Claims authority levels are enforced and claims leakage controlled.INTEGRATION SERVICES

The claims management system can be fully integrated with your current systems to protect your investment. Through seamless integration with your banking partners, the system can automate claims payments for individual invoices or on a batch basis, by payee.ONLINE SERVICES

UThe claims status and all pertaining information can be published through on-line services so that authorized users may have immediate and secure access from any device. This functionality can either be integrated into existing customer portals or a purpose built portal can be added to the system.CLAIMS MANAGEMENT

End to end management of the claims procedure. Claims can be received in a wide range of formats. Detailed claim files are maintained with a full claim history Claims can be assessed automatically with triggers set to flag claims for human review. Estimates are managed and third party recoveries controlled.FRAUD DETECTION

Potentially fraudulent claims can be identified based on pre-determined rules. Claims falling outside of norms, defined by business rules, can be identified and submitted for review or adjudication prior to payment.HFINANCIAL MANAGEMENT

Accounting entries are automatically created based on a customised Posting Template. The integrity of financial transactions is maintained through a double entry accounting system.DOCUMENT MANAGEMENT & COMMUNICATION

Inbuilt document management allows incoming communication in a wide range of formats to be attached to a claim file and saved in the system. Customised templates and standard documents can be automatically generated or created on an ad-hoc basis. Communication can be via e-mail, SMS or hard copy. Ad- hoc or batch printing and interfaces with mail houses are supportedWORKFLOW (AUTOMATED AND MANUAL)

The workflow can be customized to the specific needs of your business. Steps can be easily changed and updated. Repetitive manual tasks can be fully automated, while manual procedures for more complex tasks can be maintained within the overall workflow. The workflow process assures consistent claim handling, improves both service levels and productivity, and reduces fraudulent behaviour.BUSINESS RULES

Customised business rules can be applied at each stage of the process, including the creation and assignment of tasks, triggering of outbound communication, etc. Business rules can control the limits of authority of Claims staff ensuring all claims are managed appropriately.BUSINESS INTELLIGENCE AND REPORTING

Customized reports deliver the right information at the right time to the appropriate executive and management team, supporting timely and informed decision making. Reports can be scheduled, or accessed on an ad-hoc basis. Enables claims analyses and utilisation reviews based on a number of variables.WE TAKE SERVICE PERSONALLY

By partnering with Gratex International, you can leverage over 20 years of insurance industry knowledge and experience. You can be confident in successful system implementations that deliver predictable operational improvements. Our local team at Gratex is not only implementing a technology solution, our consultants work proactively with you to design the most efficient business processes tailored to your organisation’s practices. Learn more about our service delivery.

Our Clients

Our Partners

Gratex International Australia

Level 6, 1 - 5 Chalmers Crescent

Mascot, NSW 2020

Mascot, NSW 2020

Postal address:

P.O.BOX 7086

Alexandria, NSW 2015

Alexandria, NSW 2015

Tel: 1800 111 110 / 02 8335 1100

Fax: (02) 02 8335 1190

Fax: (02) 02 8335 1190

.png)

.png)